2022 tax brackets

13 hours agoHigher standard deduction The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. 2022 California Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

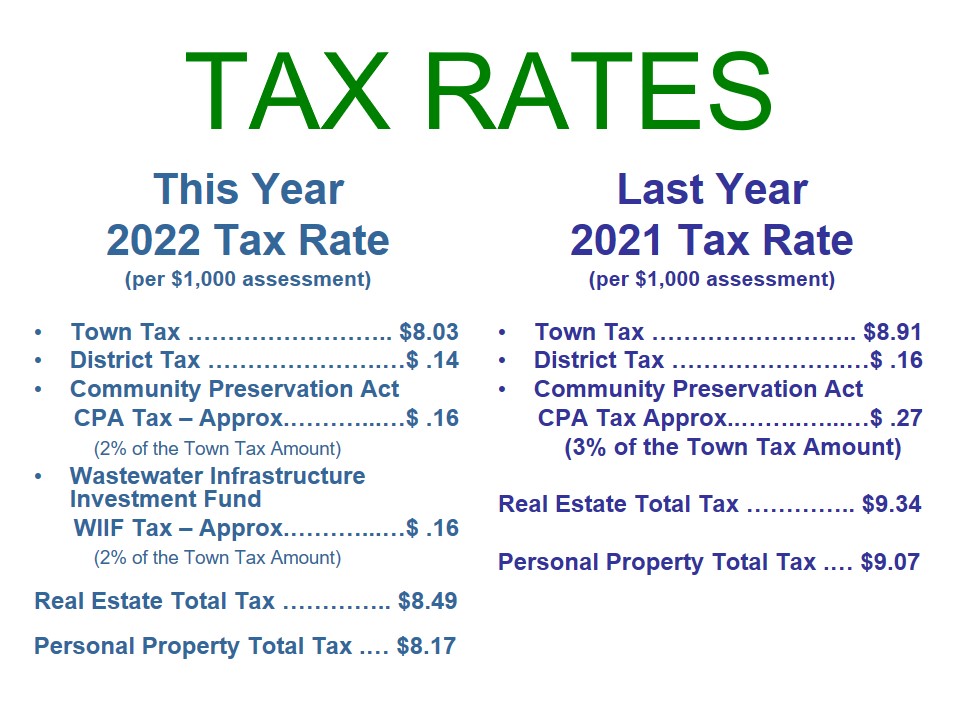

Fiscal Year 2022 Tax Rate Town Of Mashpee Ma

9 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000.

. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Below you will find the 2022 tax rates and income brackets. Compare your take home after tax and estimate.

The agency says that the Earned Income. The top marginal income tax rate. If you have questions you can.

12 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. The top marginal income tax rate. 1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140.

Your bracket depends on your taxable income and filing status. There are seven federal income tax rates in 2022. 1 day agoThe 2023 changes generally apply to tax returns filed in 2024 the IRS said.

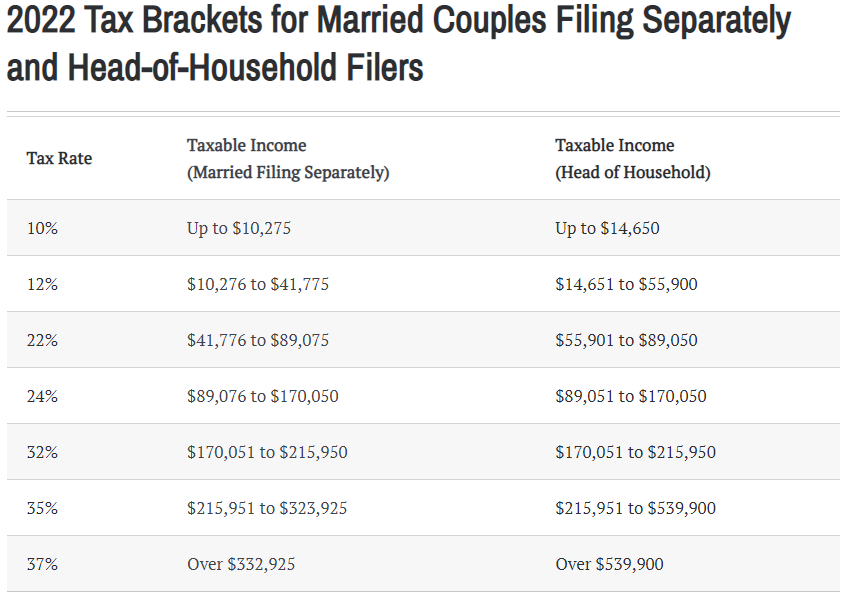

For single taxpayers and married people filing separately the standard deduction will rise to 13850 up 900. The 2022 and 2021 tax bracket ranges also differ depending on your filing status. The income brackets though are adjusted slightly for inflation.

For heads of households it will rise to 20800 up 1400. Your tax-free Personal Allowance The standard Personal Allowance is 12570. Below are the new brackets for both individuals and married coupled filing a joint return.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 8 hours ago2022 tax brackets for individuals. The current tax year is from 6 April 2022 to 5 April 2023.

The 2022 tax brackets affect the taxes that will be filed in 2023. 6 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over the perks and user reviews for the most popular tax provider services to land on the best-in-class. 10 12 22 24 32 35 and 37.

Heres a breakdown of last years income. 2022 tax brackets Thanks for visiting the tax center. Resident tax rates 202223 The above rates do not include the Medicare levy of 2.

There are seven federal tax brackets for the 2021 tax year. These are the rates for. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year.

This guide is also available in Welsh Cymraeg. Resident tax rates 202122 The above rates do not include the Medicare levy of 2. 9 hours agoFor couples who file jointly for tax year 2023 the standard deduction increases to 27700 up 1800 from tax year 2022 the IRS announcedSingle taxpayers and married people.

Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year. Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up. The seven tax rates remain unchanged while the income limits have been adjusted for inflation.

Each of the tax brackets income ranges jumped about 7 from last years numbers. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million.

There are seven federal income tax rates in 2023. To access your tax forms please log in to My accounts General information.

2022 Income Tax Brackets And The New Ideal Income

How Much You Will Be Taxed In South Africa In 2022 Based On What You Earn

Tax Season 2022 Tax Brackets Irs Forms Deadlines Pdffiller Blog

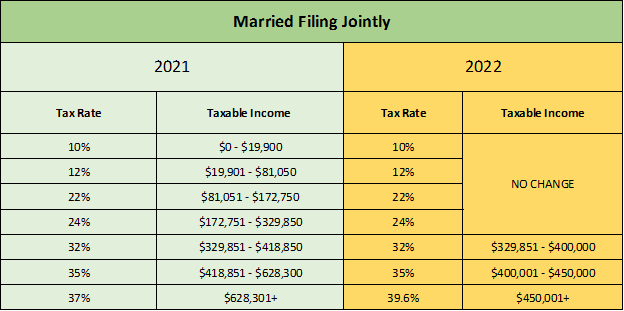

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

Tax Rates Tax Planning Solutions

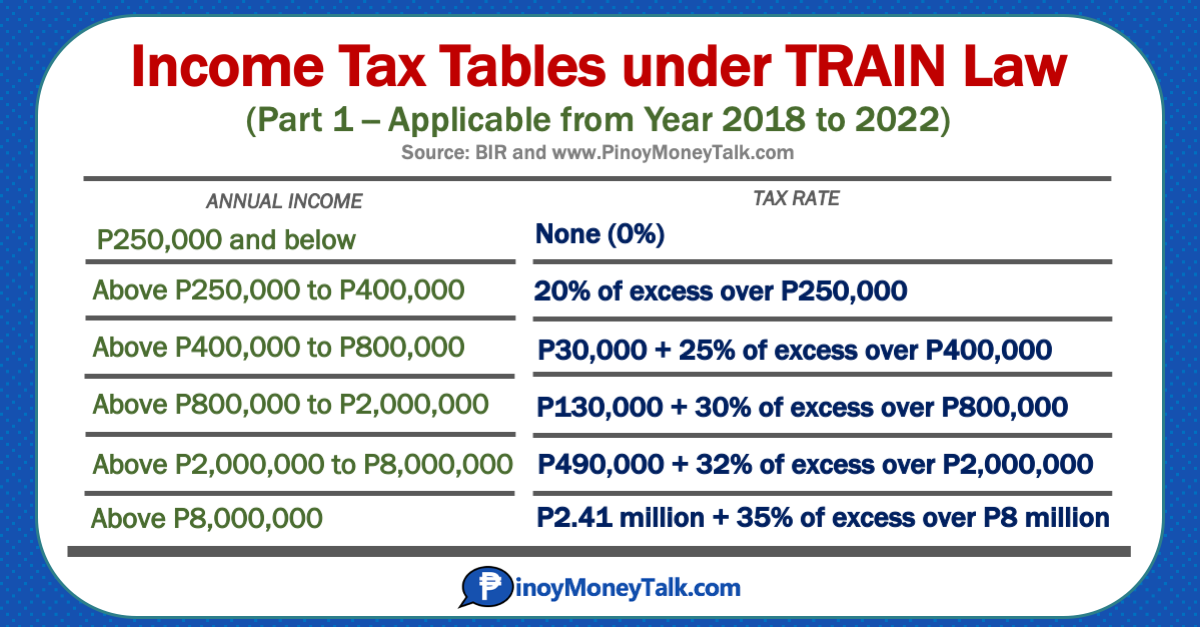

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Understanding Marginal Income Tax Brackets Gentz Financial Services

State Income Tax Rates And Brackets 2022 Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What S My 2022 Tax Bracket Green Retirement Inc

Top 15 Federal Income Tax Brackets Tax Rates In 2022 Chungkhoanaz

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

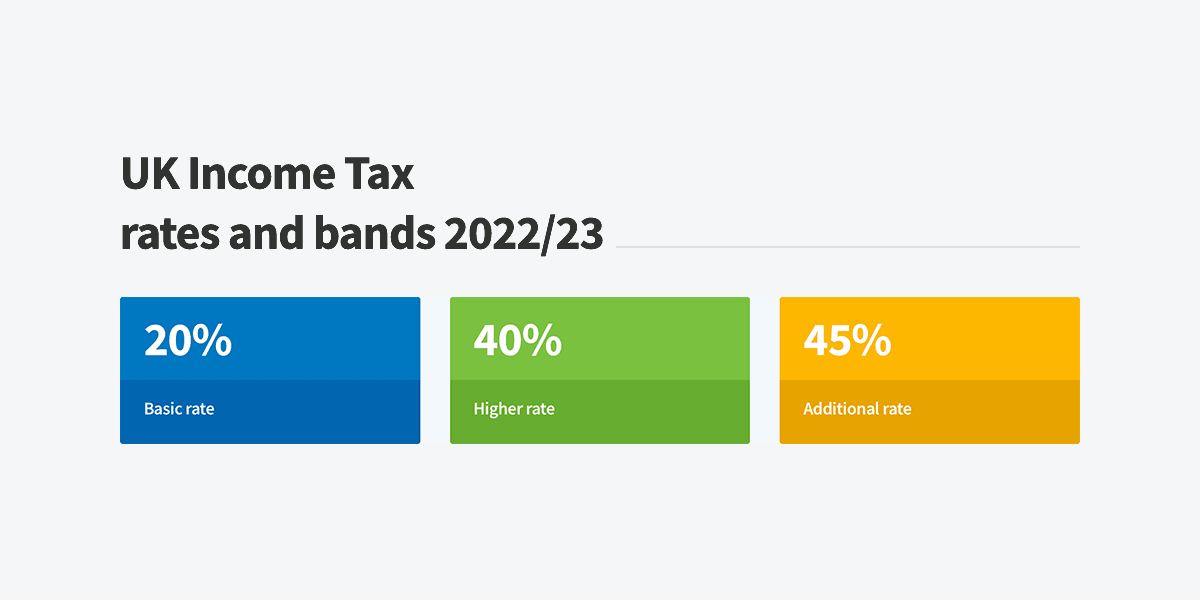

Uk Income Tax Rates And Bands 2022 23 Freeagent

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Germany Corporate Tax Rate 2022 Take Profit Org